- Home

- Technology

- India Launches RuPay Card in Maldives, UPI Expansion Next: PM Modi

India Launches RuPay Card in Maldives, UPI Expansion Next: PM Modi

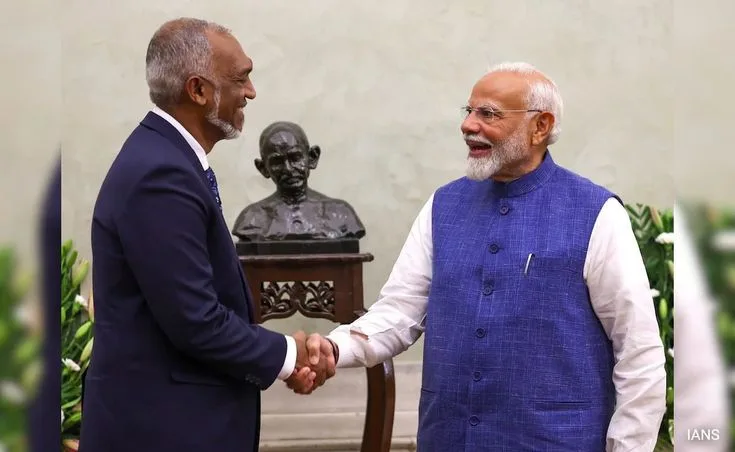

India and Maldives have taken another step towards strengthening their bilateral relations with the India Launches RuPay Card in Maldives. Prime Minister Narendra Modi recently announced this significant development, highlighting that UPI (Unified Payments Interface) will soon follow, enhancing digital financial connectivity between the two nations. This move is part of India’s broader strategy to deepen economic ties with its neighboring countries.

In his statement, the President of Maldives Dr Mohamed Muizzu said he and Prime Minister Modi held extensive discussions taking stock of our successful development journey together and charting the path of future collaborations between the two countries. He said both sides agreed on a comprehensive vision document charting the course of the bilateral relationship. Dr. Muizzu said that he is thankful for the Indian government’s decision to provide support in the form of 3,000 crore rupees in addition to 400 million US dollars bilateral currency swap agreement.

A Boost to Tourism and Trade

The launch of the RuPay and credit cards in the Maldives is expected to make a positive impact on the tourism and trade sectors. Thousands of Indian tourists visit the Maldives each year, and now with the RuPay card, their financial transactions will become smoother and more efficient. No longer will Indian travelers need to rely on international card systems or face additional transaction fees. This initiative will not only enhance convenience for Indian tourists but also encourage more Indians to explore the beautiful islands of the Maldives.

Financial Inclusion and Digital Connectivity

India Launches RuPay Card in Maldives marks an important step towards financial inclusion. For Maldives, it opens up a new digital payment channel, simplifying UPI transactions for both locals and Indian visitors. Moreover, the upcoming launch of UPI will further strengthen digital connectivity. UPI’s success in India has been immense, and its integration in the Maldives will revolutionize the way financial transactions are carried out.

In fact, UPI is known for its fast, secure, and seamless payments. Once India Launches RuPay Card in Maldives, it will allow Maldivians and Indian nationals to easily transfer funds. Make online payments, and pay bills—all through a mobile phone. This will not only benefit individuals but also businesses, making cross-border payments more accessible and cost-effective.

What’s Next?

Following the introduction of RuPay, the focus will shift to UPI’s launch in the Maldives. The Indian government is working closely with the Maldivian administration to ensure a smooth and effective rollout. Once UPI is fully operational, it will allow seamless financial transactions between the two countries, further strengthening economic cooperation.

Furthermore, this digital payment framework will benefit other sectors as well. Small and medium-sized businesses in India and Maldives can now conduct cross-border trade more easily. Reduced financial barriers will support growth in both economies.